Defer Taxes.

Unlock Wealth.

Welcome to 1031EZ , your interactive guide to a smarter 1031 exchange!

Brought to you by the seasoned pros at 1031 EZ Exchange, this site will help you turn complex rules into clear advantage. Swap investment property, defer capital-gains taxes, and grow your portfolio with confidence.

Have Questions?

Choose how you prefer to interact below

All your answers are seconds away.

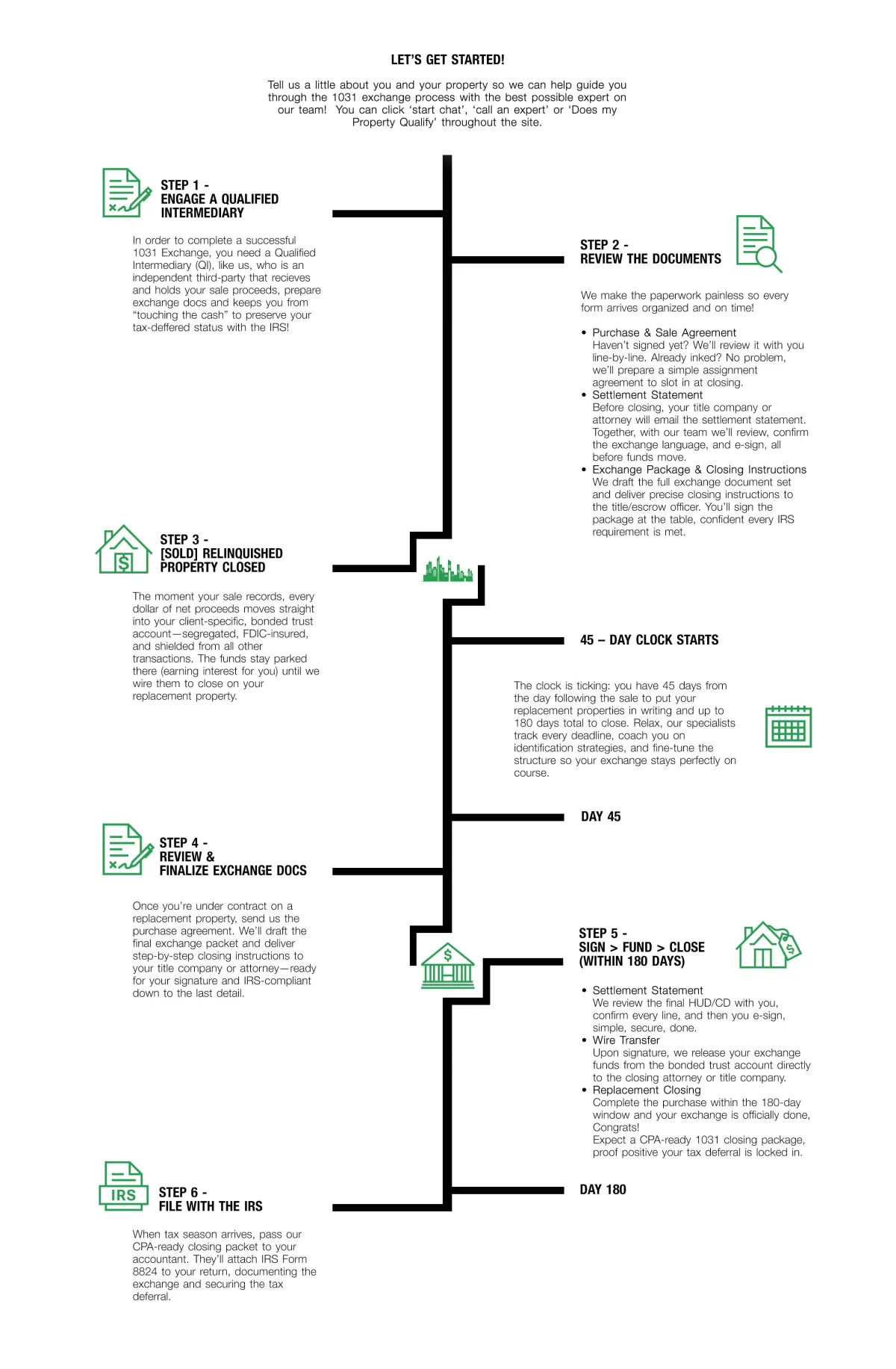

A Clear Path to Your Next Property

Fast, friendly, simple. You choose what to sell and what to buy

EZ 1031 Exchange handles every deadline, document, and dollar in between.

Top 10 1031 Exchange Rules

A 1031 exchange lets U.S. real‑estate investors defer capital‑gains taxes when swapping one investment property for another. Yet the IRS has strict rules and timelines. This concise guide outlines the must‑know rules in plain English so you can navigate your next exchange confidently. It is for educational purposes only; always verify details with a qualified CPA and attorney.

1. Like-Kind Real Property Only

2. Investment or Business Use Only

3. Use a Qualified Intermediary (QI) and Avoid Constructive Receipt

4. Write and Deliver Your Identifications by Day 45

5. Close on the Replacement Property by Day 180

6. Reinvest All Net Proceeds and Maintain Equal or Greater Debt

7. Maintain the Same Taxpayer/Vesting

8. Avoid Related‑Party Pitfalls

9. Report the Exchange on Form 8824

10. Reverse and Improvement Exchanges Require a Parking Arrangement

Proven by Experience. Chosen by Investors.

Navigating a 1031 exchange isn’t guess-work, it’s precision. The veteran team behind EZ 1031 Exchange has guided thousands of investors through every deadline, document, and dollar so you can trade up, defer taxes, and keep your wealth compounding.

1,000 +

Investors Guided

25 +

Years Mastering 1031s

1,000 +

Exchanges Closed

PRICING

Transparent Pricing, Aligned With Your Success

We believe the fee for a 1031 exchange should be as straightforward as the process we deliver. That’s why EZ 1031 Exchange charges a single, flat rate, starting at $1,249, based solely on the complexity of your transaction. No percentages. No surprise add-ons. Ever.

Flat-rate, from

$1,250

paid only when you close.

Pay-at-Closing Guarantee: Your fee is settled out of escrow at the first closing. If your exchange doesn’t proceed, you owe us nothing.

Zero Hidden Costs: What we quote is what you pay. No courier, wire, or “compliance” extras added after.

Aligned Incentives: We’re compensated only when your exchange is completed, keeping our interests 100% in sync with yours.

We’ll tailor a flat fee that fits.

Local Know-How. Coast-to-Coast Coverage.

1031 mastery in all 50 states.

Real estate rules can change from county to county, let alone state to state. EZ 1031 Exchange lives those nuances every day, delivering compliant, on-time exchanges whether you’re swapping a duplex in Denver or a medical office in Miami. Wherever your next investment takes you, our expertise is already there.

We’re here to serve you.

Our clients are the lifeblood of our business, and your goals inspire us to raise the bar every day. To prove it, we built the industry’s strongest pledge, the EZ 1031 Fiduciary Standard, guaranteeing every recommendation puts your exchange first.

Expert 1031 Exchange Guidance